A Sdn Bhd company structure provides a number of advantages including limited liability, tax benefits, and transferability of shares. Nevertheless, operating a company in Malaysia is only possible if you adhere fully to the business compliance requirements set by the Malaysian authorities. We have put together a handy compilation of monthly and annual compliance checklists to help you stay compliant. These checklists cover the main requirements for the submission of financial reports, tax information and tax payments and other related matters. By all means, you are free to appoint professionals to assist you in meeting these requirements, but as a business owner, it is also your responsibility to ensure that you are well-informed.

Annual Compliance Checklist for Sdn Bhd

1: Submission of corporate tax estimates

Due date: Within 3 months of operation/30 days before the start of the following assessment year The estimated tax payable will be calculated based on the estimated annual profit of your company. Then, you will need to make monthly instalments based on the estimated tax payable. The best practice is to engage an accountant or tax agent to help you with it, to ensure that you are doing it correctly. The tax estimates can be revised if necessary. For more information, you may visit LHDN Malaysia.2: Submission of corporate tax return

Due date: Within 7 months after the assessment year ends The initial estimated tax payable and the actual tax payable might be different. Depending on the difference between the actual tax liability and the taxes paid, companies will either pay the balance or receive a refund. This can be done through the submission of a tax return via the e-filing portal. You can either get this done yourself or engage a tax accountant.3: Submission of payroll-related statements (PCB)

Due date: By 31st March of the following year As an employer, you will need to submit Form E (Employer Return Form) and the monthly tax deductions to LHDN. In turn, your employees will receive the Form EA/(C.P. 8A), which is the Statement of Remuneration from Employment, before March every year prior to their personal income tax submission. You can find the forms here.4: Lodgement of financial statements and directors’ report

Due date: To be circulated to shareholders within 6 months after the FYE and lodged within 30 days after circulation Financial statements are prepared by accountants and audited by your appointed auditor. For SSM submission, your auditor will need to prepare the audited report, while the directors will need to prepare the directors’ report. A directors’ report provides the following information:- Details of company and any dividends

- Activities of the company

- Business reviews

5: Annual return lodgement

Due date: Submitted every year within 30 days from the anniversary of its date of incorporation Every company needs to lodge an annual return on a yearly basis. The annual return is the summary of your company information that includes:- Business nature

- Registered address

- Directors and shareholders

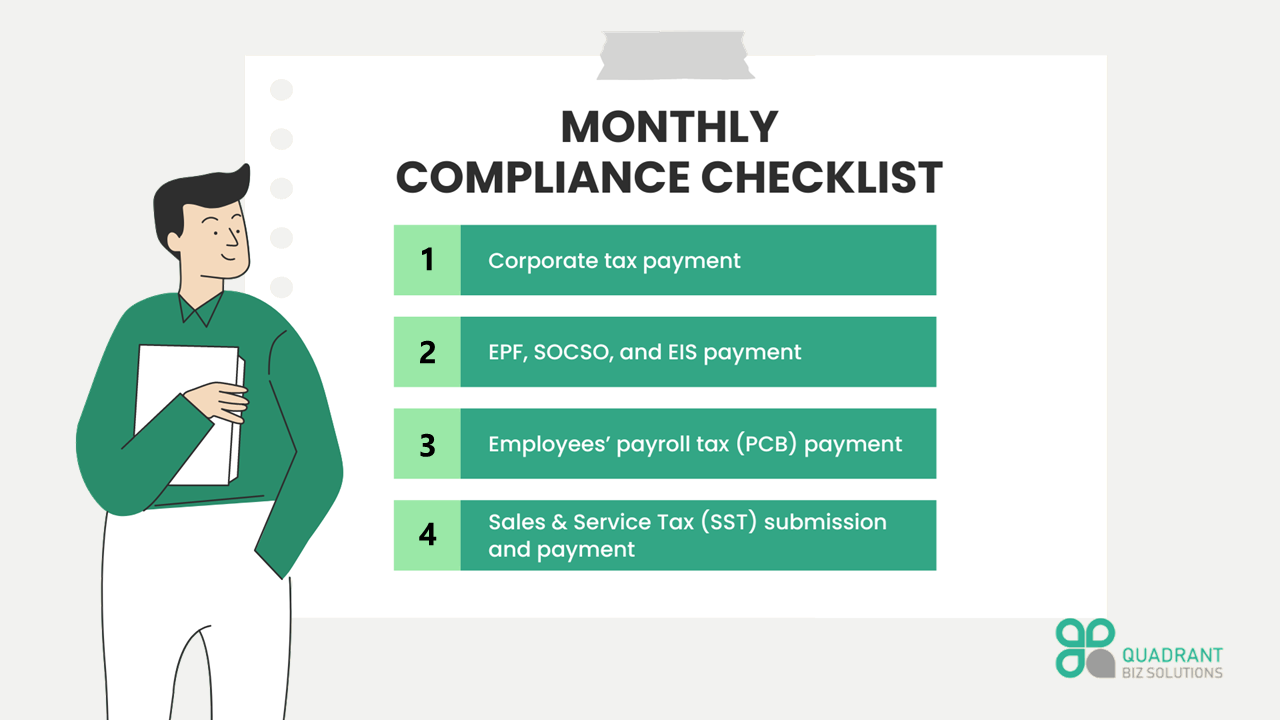

Monthly Compliance Checklist for Sdn Bhd