An Initial Public Offering (IPO) is the listing of shares on a public exchange, and is often seen as a prestigious milestone in a company’ s life cycle. Essentially, a company transfers its private ownership to a public one by offering its shares to institutional and retail investors, hence, the term “going public”. In Malaysia, Bursa Malaysia offers a choice of three markets to companies seeking for listing:

- Main Market A prime market for established companies with an aggregate profit track record of at least RM20 million for the latest 3 to 5 years, where the latest year’s profit is at least RM6 million;

- ACE Market A sponsor-driven market for fast-growing companies. Sponsors must assess suitability of the potential issuers, taking into consideration attributes such as business prospects, corporate conduct and adequacy of internal controls; and

- LEAP Market An adviser-driven market which aims to provide emerging companies, including SMEs with greater fund-raising access and visibility via the capital market. It is accessible only to sophisticated investors (as prescribed under the Capital Markets and Services Act 2007).

1: Listing requirements

| Main Market | ACE Market | LEAP Market | |

| Approving authority | Securities Commission Malaysia | Bursa Securities | Bursa Securities |

| Profit test | Aggregate profit track record of at least RM20 million for the latest 3 to 5 years where the latest year’s profit is at least RM6 million | No minimum requirement | No minimum requirement |

| Market capitalisation test | Total market capitalisation of at least RM500 million upon listing | No minimum requirement | No minimum requirement |

| Public shareholder spread | At least 25% of the company’s total number of shares; and Minimum of 1,000 public shareholders holding not less than 100 shares each. | At least 25% of the company’s total number of shares; and Minimum of 200 public shareholders holding not less than 100 shares each. | At least 10% of the company’s total number of ordinary shares at admission. |

| Moratorium on promoters | Promoters’ entire shareholdings for 6 months from the date of admission. | Promoters’ entire shareholding for 6 months from the date of admission. Must maintain at least 45% of shareholding for the next 6 months and thereafter, further sell down is allowed on a staggered basis over a period of 3 years. | Promoters’ entire shareholding for 12 months from the date of admission. Must maintain at least 45% of shareholding for the next 36 months |

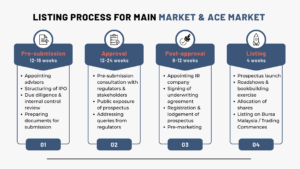

2: Listing process

The listing process – from the time you engage an adviser to the day of listing – will normally take 9-12 months, depending on the structure and complexity of the listing scheme. Upon approval, you will be given six months to complete your IPO exercise.

3: Advantages of a public listing

The main advantages of listing a company include:

- Market exposure and economic prestige

- Ability to tap public markets opportunistically

- Attract, motivate and retain key employees by offering an ESOP (Employee Share Option Scheme)

- Provide liquidity to company shares

- Enable current investors to realise their investments – taking profit on their investments (though management and key investors are usually subject to a 180-day lock-up period)

- Economic leverage when applying for loans from financial institutions

- Increased visibility among institutional traders, mutual and hedge funds.

4: Drawbacks of listing

While going public allows the company to raise a large amount of funds from the stock market, it also involves some disadvantages, making this decision one of the most important choices a private company can make. The disadvantages include:

- Loss of management control

- Volatility of share price, which is correlated to value of the company

- Greater accountability and increased level of scrutiny from shareholders and general public

- Increased disclosure and reporting requirements

- Equity dilution

- Performance pressure from shareholders and the public

- Expensive upfront cost of listing

Weighing up the Pros and Cons

So, should you “go public?” There are many factors to consider before making an initial public offering (IPO) such as timing, how much control you are willing to yield to your shareholders, and regulatory constraints. Be sure to spend sufficient time reviewing the pros and cons of going public and how it would affect your day-to-day business decisions versus future growth potential. For professional advice and guidance, do get in touch with our team at Quadrant Biz Solutions who have extensive experience with listing exercises.