Before starting a business in Malaysia, you will first need to register a business entity with The Companies Commission of Malaysia (SSM) within 30 days from when you start operating.

Given there are different types of entities available, it is crucial to first understand their functions and associated pros and cons to ensure that the option you select suits your business goals.

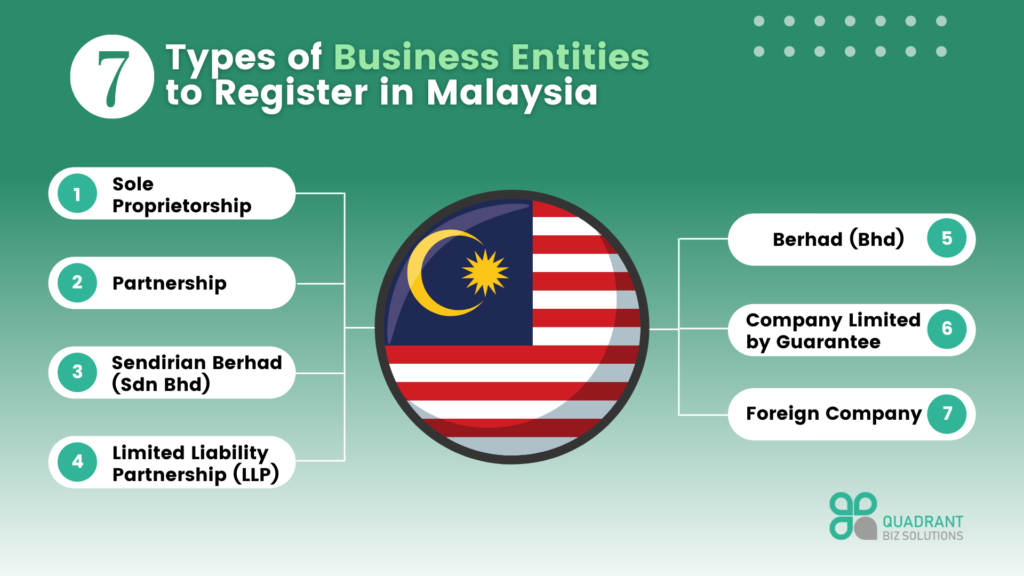

7 Types of Business Entities in Malaysia

1. Sole Proprietorship/Perniagaan Tunggal

A Sole Proprietorship, also known as an Enterprise, is the simplest business entity to get started with if you are thinking of starting a small business yourself. You can register a Sole Proprietorship using your personal name or a trade name. This can be done online via Ezbiz Online services or over the counter at SSM.

Registration Fee

- Personal name as per identity card: RM30

- Trade name: RM60

Characteristics of a Sole Proprietorship

- It is owned by just one individual and the business has unlimited liability.

- Only Malaysian citizens or permanent residents (PRs) can set up a Sole Proprietorship.

- All profits and losses go directly to the business owner.

| Advantages of a Sole Proprietorship | Disadvantages of a Sole Proprietorship |

| Cheap to register and simple to set up. No statutory audit is required. Full control of the business and revenue. | Unlimited liability to the owner: Personal income or assets of the owner will not be protected if the company is declared bankrupt or in debt. Unfavourable tax rate: Profits are taxed at business owner personal income tax. |

2. Partnership/Perniagaan Perkongsian

If you are setting up a business with partners or associates, a Partnership (also sometimes referred to as an Enterprise) is the easiest business entity to begin with. Similar to a Sole Proprietorship, this type of business is bound by unlimited liability.

Registration Fee

- Trade name: RM60 (identity card name cannot be used as business name).

Characteristics of a Partnership

- It is jointly owned by two or more individuals – maximum 20 partners.

- It is governed by the Partnership Act 1961 or self-created partnership agreements.

- Only Malaysian citizens or permanent residents (PRs) can set up a Partnership.

| Advantages of a Partnership | Disadvantages of a Partnership |

| Cheap to register and simple to set up. No statutory audit is required. Shared liability among partners. | A Partnership is not a separate legal entity. Each partner is jointly liable for liability of the Partnership as there is unlimited liability. Higher tax rate: Any business profits from the Partnership are taxed at the individual tax rate of each partner. |

3. Private Limited Company/Sendirian Berhad (Sdn Bhd)

A Sdn Bhd company is a private company limited by shares. It is a separate entity from its owners – which means the owners are liable only up to the amount they have contributed to the company. If you are looking to run an SME business, a Sdn Bhd is considered a more creditworthy and formal business structure as compared to a Sole Proprietorship or Partnership.

Registration Fee

- RM2,500 – RM3,000

Characteristics of a Sdn Bhd

- It can have 1 to 50 shareholders. You can be the only director/shareholder of the company without other business partners.

- Open to non-Malaysians, but at least one director must be a Malaysian resident.

- A minimum paid up capital of RM1.

- It can carry on business, enter into a contract, and can sue or be sued.

| Advantages of a Sdn Bhd | Disadvantages of a Sdn Bhd |

| Limited liability to the owner /shareholder Favourable tax rate. Can be 100% foreign-owned. Can be converted to Berhad to raise public funds. | Higher cost of incorporation. Higher maintenance costs as it requires annual audited accounts to be submitted each year. |

4. Limited Liability Partnership (LLP)/Perkongsian Liabiliti Terhad (PLT)

An LLP is a relatively new corporate structure governed under the Limited Liability Partnership Act 2012. It is a combination of a Sdn Bhd company and a Partnership.

Registration Fee

- RM500

Characteristics of an LLP

- A minimum of 2 partners are needed to form an LLP – no maximum number of partners.

- Only Malaysian citizens or permanent residents (PRs) can set up an LLP.

| Advantages of an LLP | Disadvantages of an LLP |

| Limited liability for each of the partners – similar to a Sdn Bhd, in the event that the LLP is sued or declared bankrupt, creditors are not able to go after the owners or their personal income and assets. Cheaper incorporation and maintenance costs. Fewer compliance requirements – not required to audit its accounts annually. Favourable tax rate – corporate tax. | Relatively new, confusing to many. Not easy to obtain bank loans. |

5. Public Limited Company/Berhad (Bhd)

A Bhd company is an entity whereby shares of the company are offered for purchase to the public. In most cases, a Sdn Bhd is converted to Bhd to raise public funds. The share capital of a Bhd can be raised from the public through an initial public offering (IPO).Traditionally, a Bhd company raises public capital through an Initial Public Offering (IPO), though recent alternatives include Reverse Takeovers (RTO) or listing via a SPAC (Special Purpose Acquisition Company) acquisition / offering.

Characteristics of a Bhd

- Unlimited number of shareholders.

- Public listed on Bursa Malaysia Stock Exchange and governed by Securities Commission of Malaysia.

| Advantages of a Bhd | Disadvantages of a Bhd |

| Able to raise funds from the public by issuing shares. Limited liability restricted to ownership of shares. Access to public markets to raise capital efficiently for growth opportunities. | Costly and difficult to register. Strict compliance and regulatory requirements to follow – a Bhd is required to disclose Financial Reports and Annual Reports to the public. |

6. Company Limited by Guarantee (CLBG)

A CLBG is a public company not bound by shares and is used for non-profit purposes. There are no shareholders, only members who act as guarantors to run the operation. No profits are to be distributed amongst the members of the company. A good way to find out which are CLBGs in Malaysia would be to look for these words in the name: Fund (Tabung), Corporation (Badan), Foundation (Yayasan), Alliance (Gabungan) etc.

7. Foreign Company

A Foreign Company is for non-Malaysians who have established businesses in other countries and want to set up a branch in Malaysia.

Characteristics of a Foreign Company

- It is an extension of the foreign parent company.

- Not a separate legal entity – the foreign parent company is liable and responsible for all the debts of the branch in Malaysia.

| Advantages of a Foreign Company | Disadvantages of a Foreign Company |

| Allows foreigners to run businesses in Malaysia without having a local director. | Not allowed to carry out trade-related businesses. The liabilities of a branch office extend to its parent company. |

Make the Right Choice

As they say, well begun is half done. Starting a business is an exciting yet scary moment. Make sure you do your research thoroughly before making this important decision.

Need help to decide which type of business entity is best suited to your goals?