The implementation of e-invoicing aims to support the growth of Malaysia’s digital economy and enhance the efficiency of its tax administration. E-invoices will replace traditional paper-based invoices, improving the efficiency of recording financial transactions and facilitating real-time data collection. The Inland Revenue Board of Malaysia (IRBM) has outlined specific requirements and the various methods available for transmitting e-invoices to the IRBM.

All individuals and legal entities are required to comply with the e-invoicing requirement, including:

- Associations

- Body of persons

- Branches

- Business trusts

- Co-operative societies

- Corporations

- Limited liability partnerships

- Partnerships

- Property trust funds

- Property trusts

- Real estate investment trusts

- Representative offices and regional offices

- Trust bodies

- Unit trusts

The e-invoice mandate covers the below document types:

- Invoice

- Credit note

- Debit note

- Refund invoice

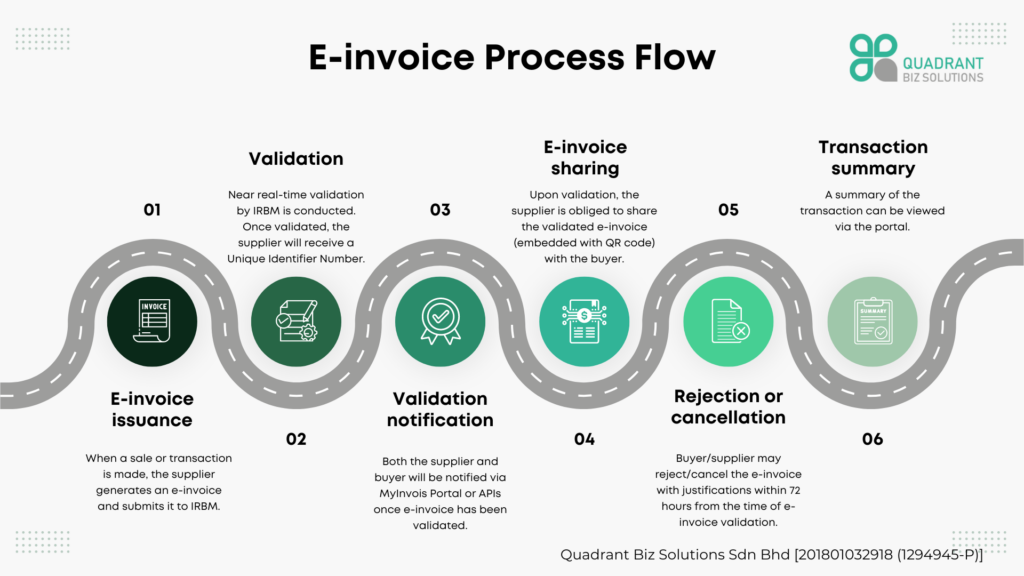

E-invoice process flow

- E-invoice issuance: Taxpayers must submit e-invoices to the IRBM via the MyInvois portal or through a third-party e-invoicing software API in XML or JSON format.

- Validation: Once submitted, the e-invoice is validated in real-time and a Unique Identification Number, validation link (QR Code) and PDF format of the validated e-invoice are sent to the supplier.

- Validation notification: Once the e-invoice is successfully validated, notification will be sent to the supplier and the buyer.

- E-invoice sharing: Upon validation, the supplier is obliged to share the validated e-invoice (embedded with QR code) with the buyer. The QR code can be used to validate the existence and status of the e-invoice via MyInvois Portal.

- Rejection or cancellation: Optional rejection (buyer side) and optional cancellation (supplier side) requests have a 72 hour time limit, after which the invoice is considered valid. Any corrections or amendments made after the 72 hour limit will need to be made through credit, debit or refund notes.

- Transaction Summary: A summary of the transaction can be viewed via the portal

Options to transmit e-invoices to IRBM

- A portal (MyInvois Portal) hosted by IRBM

The IRBM provides an e-invoicing portal where businesses can directly upload their e-invoices. This portal is designed to be user-friendly and ensures that the invoices are immediately recorded in the IRBM’s system.

- Application Programming Interface (API) directly or indirectly to IRBM

The IRBM offers an Application Programming Interface (API) that businesses can use to connect their invoicing software directly to the tax authority’s system. This method is suitable for businesses that have customised invoicing solutions and require a seamless integration process. Options to transmit e-invoices to IRBM

Benefits of e-invoicing

- Efficiency and cost savings

Automation: Automating the invoicing process eliminates manual tasks, speeding up invoice generation, delivery, and payment cycles.

Cost reduction: Significant savings are achieved by reducing expenses related to paper, printing, postage, and storage. - Reduced errors

Data accuracy: Structured formats and automated processes reduce the risk of errors associated with manual data entry, improving overall data accuracy. - Improved compliance

Regulatory adherence: E-invoicing systems ensure that all invoices meet IRBM regulations, reducing the risk of non-compliance and associated penalties. - Enhanced transparency

Real-time access: Digital records provide real-time access to invoice data, enhancing transparency and facilitating easier tracking and auditing of transactions.